Crossing the Chasm - The Interactive Demo Market in 2024 & Beyond

CEO, Co-Founder

When we first started Navattic in 2020, we had the hypothesis that bringing custom-developed interactive experiences created by a few fringe growth teams to the broader market would be transformative. It just seemed intuitive that buyers wanted to self-educate and see how the product worked.

It turns out there was a strong appetite for a solution that enables teams to create these experiences no-code and it’s been a true privilege to be at the front of a rapidly growing and constantly evolving interactive demo market. Our aim in the below post is to share learnings on the market’s progression and take a stab at what’s in store for 2024 and beyond.

2020 & 2021: Defining the Interactive Demo Market

On prospect and customer calls in 2020 and 2021, much of the conversation revolved around “what are interactive demos?” and “how could they be used?” In many ways, we were still answering that question alongside our customers. As the months went by though, this nebulous concept of interactive demos solidified into an array of concrete use cases across marketing, sales, and customer success. We truthfully were continually impressed by the novel ways customers continued to use our product; from feature launches, to demo centers, to inclusion in playbook galleries and recruiting posts. The list was long and we were excited to see teams using the product and adopting the concept in such an explosive way.

With the newfound exuberance for interactive demos and the overarching category “Demo Automation,” a suite of new vendors launched into this space. Some with impressive amounts of funding and a ballooning team size week over week. It truly felt unprecedented to be in such a nascent space that received such focus, investment, and early entrants. With new companies launching left and right, many companies sought to solve a wide array of demo problems. Generally speaking, companies tended to launch into four buckets (as bucketed by their approach):

Demo Tech Approaches

- HTML/CSS captures

- Demo environment cloning

- Screenshot-based product tours

- Data-injection into live environments

2022: A Growing Contingent Adopts Interactive Demos

In 2022, we saw market adoption of interactive demos continue to power forward. Approaching three years on the market, we started to have a compelling data set that could be used to share data-driven best practices with customers. It turns out, for example, that the highest converting demos across our customer base are 8 to 15 steps and have less than 75 words per step. Small tweaks like these helped customers see outsized value in their interactive demo deployments.

It was also during this time that we gained a key insight into another key facet of the interactive demo market firsthand. The “live demo problem”, or technical sales teams facing challenges around maintaining and customizing complex demo environments, is a 12/10 problem for some teams. As shared in-depth in this writeup, we heard consistently from prospects that they wanted to customize, own and manage their demo environment. Ideally, this would allow AEs to conduct high-level demos, enabling SEs to engage in more strategic/high-value deals and projects. After our product team executed extraordinarily well on this product offering, many painful customer experiences made it clear that linking these screens was not the most effective way to solve this particular live demo problem.

This speaks to a broader trend we’ve seen in the demo market. Initially, SaaS DemoTech vendors and customers alike are co-testing solutions to see if the wide array of demo problems (which up to this point have not been addressed), could be solved via software. In 2022 and even into 2023, many customers came to learn that only a subset of their demo problems could be effectively and repeatably solved via software solutions.

That said, guided demos continued to be a hit for sales teams and marketing teams alike in 2022. In 2022, we were fortunate to see prolific customer usage; some customers created hundreds of interactive demos in their workspace. We had a subset of our analytics-focused customer track demos in-depth and many saw staggering results; one customer saw a 430% increase in conversion after using interactive demos in an A/B test versus video content.

As the year progressed, we saw the market continue to evangelize the idea of placing a “product tour” option on their website. To put some numbers behind this, we ran a market analysis to evaluate 5,000 top B2B SaaS websites paying close attention to the call-to-action language used to engage site visitors. Of that group of sites, we found that just 4.9% used language to reference a form of “product tour.”

2023: Interactive Demos Holding Their Own

For many in SaaS, 2023 was a deeply challenging time. Layoffs persisted across the sector and contractions and churn increased across the board. While we can’t say Navattic and the interactive demo market was entirely immune (there still was a slowdown, resistance to annual deals and an increase in price sensitivity), the market continued to maintain it’s strong appetite for interactive demos.

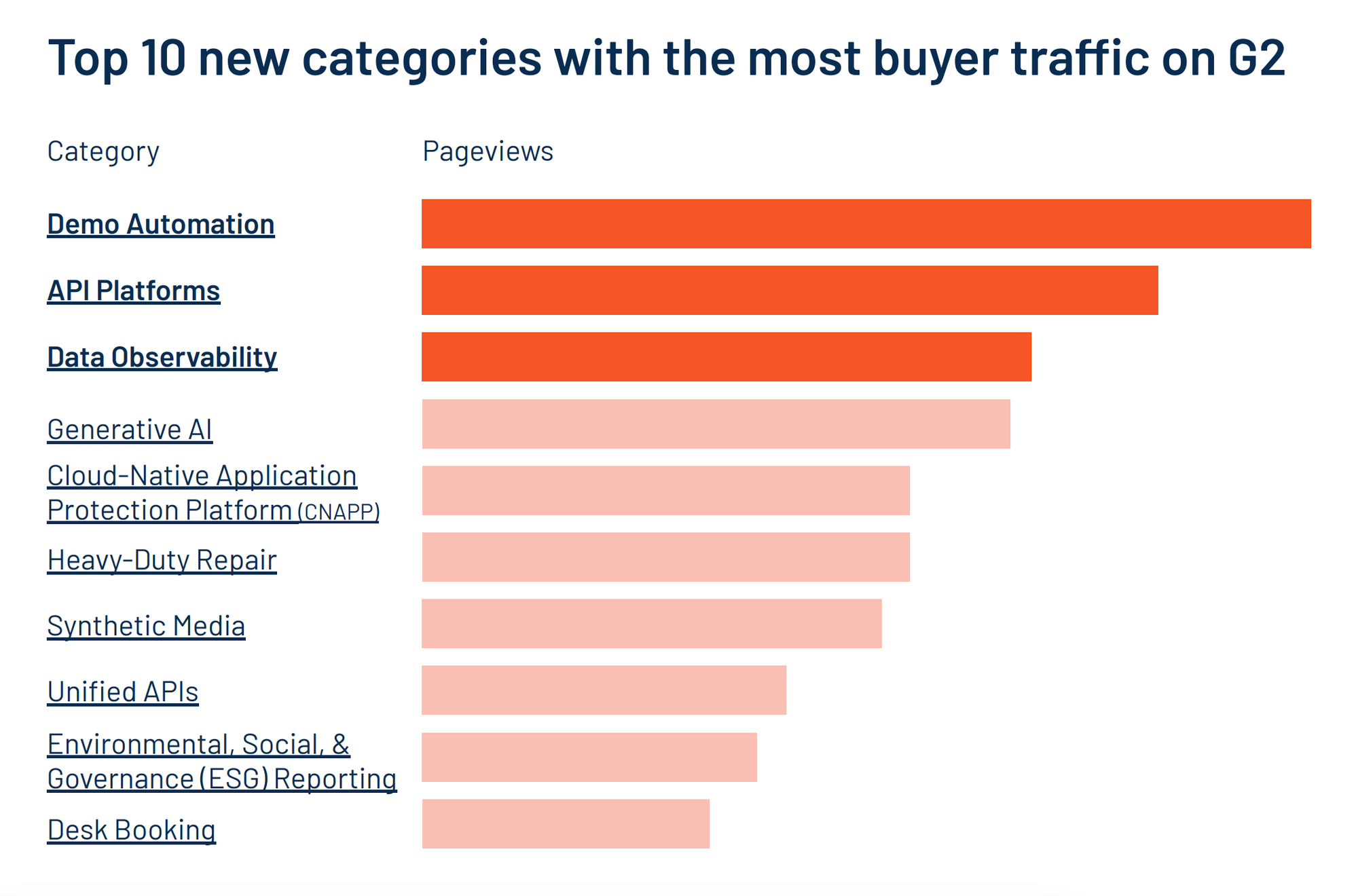

G2’s 2023 Q4 State of Software report listed Demo Automation as the fastest growing category (by "new categories with most buyer traffic").

This quantitative data backed what we felt in 2023; teams far and wide were exploring interactive demos. In particular, they wanted to know how to deploy interactive demos in a way that best aligned with their core needs of the moment. This year, we saw that the growth mentality shifted and GTM leaders started prioritizing interactive demos as a tool to do more with less. Tightening budgets meant that teams could no longer rely on volume spending to hit their numbers, they needed to optimize their sales cycle and match how their buyers wanted to buy. Self-service interactive demos met this need and allowed growth teams to showcase product functionality at scale, while driving conversions on the marketing and sales side alike.

While we can’t speak authoritatively for other companies, we did notice across the board that buyers appear more educated on the interactive demo market. The days of coming in with a litany of demo problems and having the expectation that they could all be solved via software were largely behind us (at least in chatting with the folks who came inbound on the Navattic end).

In 2023, we were fortunate to see word of mouth substantially increase. It’s so rewarding to see our longstanding focus on the customer experience pay off. During this time, we onboarded an array of customers across the spectrum; from small startups to large enterprises (including large enterprise customers like a Top 5 National Bank, a multi-national automaker and many well-known publicly traded software companies).

Looking at that same market analysis of 5,000 top B2B SaaS websites, we now saw 9.3% of these sites referencing a form of “product tour” CTA for site visitors - a 90% increase from 2022. Kyle Poyar saw similar numbers when he ran a survey in his Growth Unhinged community and estimated market adoption to be ~14%. It’s a pretty staggering number for a category created in 2020.

2024 - what is next for interactive demos?

All signals suggest that 2024 is the year that interactive demos start to ”cross the chasm.” In studying the product adoption curve, the early majority segment comprises roughly one-third of the entire market. Based on trends in website adoption of interactive demo content and overall market awareness, we believe that the interactive demo market is due for its next inflection point in 2024 as we start to approach wider market adoption. Based on growth trends over the past 24 months, the interactive demo is set to graduate from the early adopter segment to the early majority in the next year.

In many ways, it means there has never been a better time to be a customer of interactive demo software. The software has gotten 10x better since launching in 2020 and the playbooks for successful deployments have now been written and tested. We hope this allows a greater and greater segment of the market to adopt interactive demos and see what a growing subset of teams already knows; interactive demos are a compelling way to educate buyers and drive conversion. Building on this, we expect the following themes to hold true in 2024:

1. Use Case Penetration - As interactive demos become easier to build and more feature-rich, we expect to see them adopted by an increasing number of departments and teams.

2. Uptick in Interactive Demo Conversion - We at Navattic spend a lot of time thinking about how to help customers increase demo conversion (and if there are features we can bake in that would make this even easier for customers). Given the features rolled out in 2023 and those forthcoming in 2024, we can expect baseline conversion rates to increase across customers of interactive demo software.

3. Provider Distinction - As the market matures, we’ll start to see customers continue to self-select demo software providers depending on their key use cases, with an eye towards software solutions that have solved demo problems for a referenceable and wide customer base. We believe the wild-west days of demo software are largely behind us.